The Senate has raised concerns about the latest Central Bank of Nigeria (CBN) policy on cash withdrawals.

Senate Minority Leader Phillip Aduda in a point of order during plenary on Wednesday called the attention of his colleagues to the new policy and demanded for caution as it will affect many Nigerians, especially small business owners.

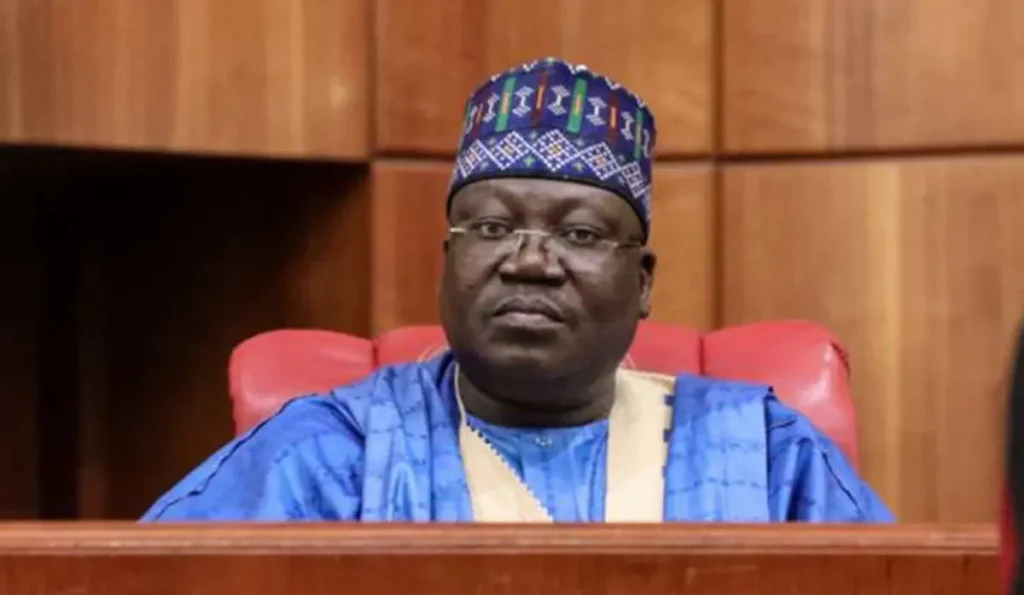

In his response, Senate President Ahmad Lawan cautions the CBN not to approach the policy by jumping into it at once as many Nigerians will be affected.

He further noted that there is a need to engage the CBN in discussions to get more details of the policy and he directs the committee on banking to discuss this matter during the screening of the CBN Deputy Governors expected to hold before next week.

The Senate has set next Tuesday to debate the new CBN policy.

Under the new withdrawal policy, the CBN restricted the maximum cash withdrawal over the counter (OTC) by individuals and corporate organisations per week to N100,000 and N500,000 respectively.

The CBN stated, however, that withdrawals above the thresholds would attract processing fees of 5 per cent and 10 per cent respectively for individuals and corporate entities going forward.

In addition, third-party cheques above N50,000 shall not be eligible for OTC payment while extant limits of N10 million on clearing cheques still remain.

The new withdrawal regime further pegged the maximum cash withdrawal per week via Automated teller Machine (ATM) at N100,000 subject to a maximum of N20,000 cash withdrawal per day.