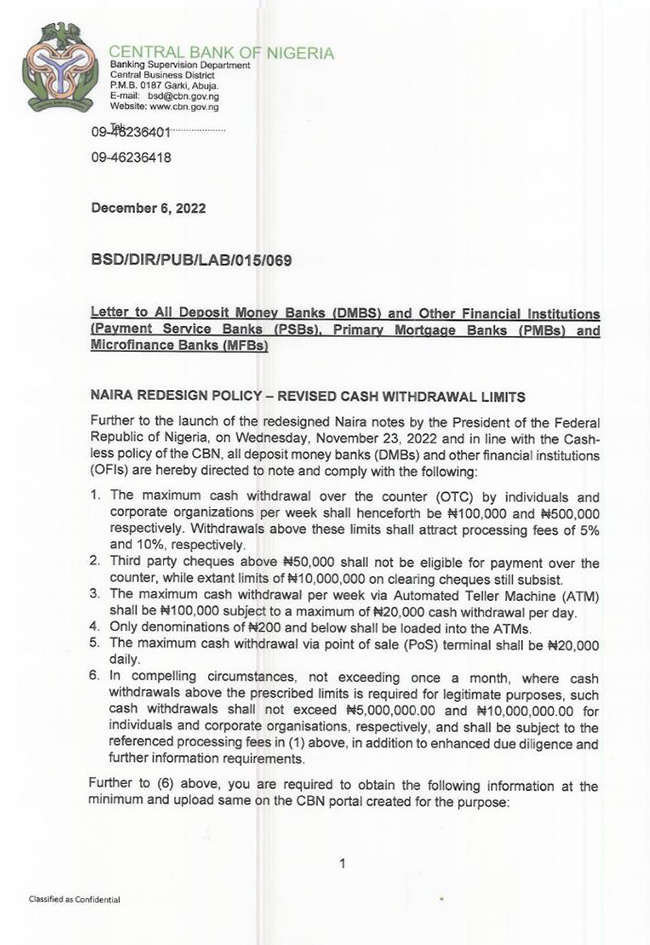

The Central Bank of Nigeria (CBN) has ordered Deposit Money Banks (DMOs) and other financial institutions to ensure that weekly over-the-counter (OTC) cash withdrawals by individuals and corporate entities do not exceed N100,000 and N500,000, respectively.

The apex bank made this known on Tuesday in a circular signed by CBN Director of Banking Supervision, Haruna Mustafa.

The apex bank said the regulatory directives take effect nationwide from January 9, 2023.

The CBN further fixed daily maximum withdrawals via point of sale (PoS) terminal at N20,000.

“The maximum cash withdrawal per week via Automatic Teller Machine (ATM) shall be N100,000 subject to a maximum of N20,000 cash withdrawal per day.

“Only denominations of N200 and below shall be loaded into the ATMs,” the bank also said, adding that the new policy is sequel to the launch of the redesigned N200, N500 and N1,000 notes by President Muhammadu Buhari on November 23, 2022.

CBN Governor, Godwin Emefiele had on October 26, 2022 announced the redesigning of the three bank notes, saying the new and existing currencies will remain legal tender and circulate together until January 31, 2023.

The apex bank believes that the redesigned notes will limit cash in circulation and therefore restricts the heinous activities of ransom-demanding kidnappers as well as politicians won’t be rigging elections.

However, the Peoples Democratic Party (PDP) and some eminent Nigerians including Governor Godwin Obaseki of Edo State as well as the General Overseer of the Redeemed Christian Church of God (RCCG), Pastor Enoch Adeboye, have faulted the naira redesign as having no basis in economics.

Read CBN’s full circular: