|

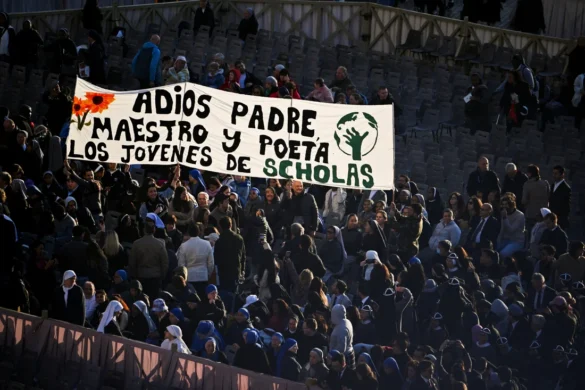

| A general view shows a section of the plant at the Dar Petroleum Operating Company oil production operated in Palogue oil field within Upper Nile State in South Sudan |

South Sudan plans to more than double oil production to 290,000 barrels per day (bpd) in fiscal 2017/2018, the finance minister said on Friday, indicating a target higher than the level recorded shortly before conflict erupted in late 2013.

The nation, which seceded from Sudan in 2011 but plunged into civil war just over two years later, aimed to add 160,000 bpd to existing output of 130,000 bpd in the financial year starting in July, Minister Stephen Dheiu Dau told Reuters.

“The resumption is underway,” he said in an interview in the South Sudanese capital Juba, referring to the plan to increase output. “The conflict has affected the facilities, including the power.”

Increased output would provide desperately needed revenues for a government which since independence has relied on oil for almost all income, which has plummeted as production plunged and international crude prices slid.

Starved of foreign exchange, South Sudan’s pound has plunged in value, inflation soared to more than 800 percent a year and the government of one of the world’s poorest nations has struggled to pay state workers and soldiers.

The main oil firms involved in South Sudan, which produced about 245,000 bpd until fighting flared at the end of 2013, are China National Petroleum Company (CNPC), Malaysia’s state-run oil and gas firm Petronas and India’s ONGC Videsh.

South Sudanese officials have in the past said production reached as high as 350,000 bpd but fell after a row with Sudan over fees for pumping crude through an export pipeline prompted Juba to temporarily halt production in 2012.

Even after resuming following that halt, it never fully recovered to those levels. It dropped to 245,000 bpd after fighting erupted in 2013, often affecting oil producing areas in the north.

Dau said inflation had slowed to 10 percent a month, and the government would help the central bank to build foreign exchange reserves. He did not give a current level for reserves.

“We will … reduce the money supply in circulation,” he said. “We will stop our borrowing from the central bank, it’s one of the causes that led to inflation.”

In December, the International Monetary Fund said the government’s 2016/2017 budget was “an important step in the right direction”, saying it cut the forecast deficit to 9 percent of gross domestic product from 30 percent in 2015/2016.

The conflict that has often followed ethnic lines pitted President Salva Kiir, an ethnic Dinka, against his former deputy and longtime political rival Riek Machar, a Nuer.

A peace deal signed in 2015 failed to hold, and sporadic fighting has continued even after Machar fled the country last year.